Get Started With Purchasing

Join our family by simply entering your email. In return, you will receive access to our custom dashboard filled with interactive calculators and resources to help educate you or your family about the mortgage process.

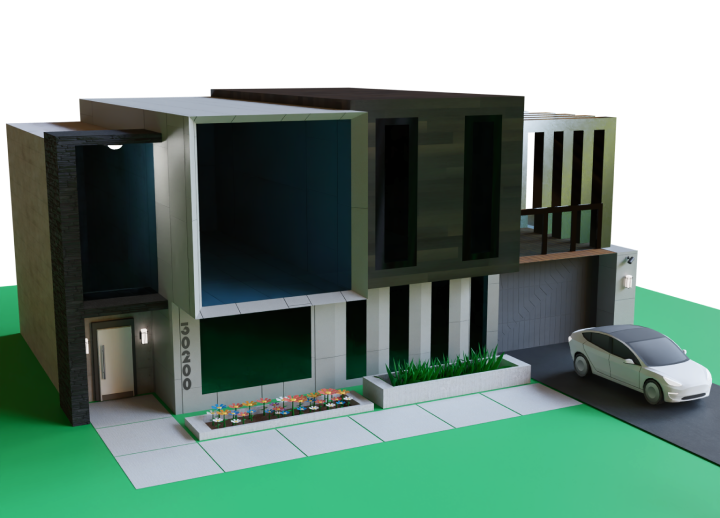

Thinking about purchasing?

These things matter to us when it comes to finding you the right home

Found A

Home You Love?

Home You Love?

Here at Next Door Lending, our personalized dashboard offers the tools to calculate mortgage payments on any home of your choosing! Join our familly now to find out!

Want To Know How Much Money You Need To Close?

Utilizing our dashboard, find out how little you need to get into a home leveraging our interactive calculator!

Have A Home You’re Thinking Of Selling?

Use our dashboard calculator to estimate how much money you will make selling your home!

What does purchasing look like?

Here is an insight into the typical purchase process

1

Get Pre Approved!

Join our family to use our dashboard and connect with one of our mortgage brokers to get pre approved!

2

Connect with a realtor!

Join our family to use our dashboard and connect with one of our mortgage brokers to get pre approved!

3

Submit An Offer On A Home!

When you submit an offer with your realtor, use our tools to confidently estimate your payment on the home!

4

Close in a timely fashion!

Leveraging our dashboard, we give you real time updates that track your mortgage process all the way to closing!

Want to learn more?

We offer a wide variety of resources from blogs, video content and mortgage terms to help educate you on the purchase process.

Want more education on mortgages and financial literacy?

Mortgage Terms

Fixed Rate Mortgage

A fixed-rate mortgage is perfect for anyone that wants stability or certainty when it comes to their finances. With this loan, we know exactly how much our monthly payment will cost us thanks to its static interest rate. This type of loan also helps with being able to accurately plan out what amount we need saved each month so that there's no surprises down the line should interest rates rise unex.....

Purchase Agreement

When buying a home, the purchase agreement is an important document that outlines all of the necessary information for transferring title. The contract includes details about things like price and down payment requirements as well as contingencies to protect both parties in case something goes wrong with financing or other issues arise during closing.

Wanna Learn

more

mortgage

terms?

more

mortgage

terms?